New developments in inverter architecture suggest that string inverters have charged forwards again to take on the challenge and kick central inverters off the throne in the utility-scale market. Hardware design innovations allowing to cut down BoS capex and improve efficiency of the plants might push string inverters further to take more space in the utility-scale market place.

Refu and Energy Transfo in front of RefuCube. The project in Morocco uses the centralised string inverter concept. Enclosed in the container, together with other gear, are the inverters.

The battle between string and central inverters is heading into another round. Increasing price pressure and ever new possibilities of digitalization have evoked a wave of high-tech solutions to age-old PV issues. Now that most inverter suppliers are brushing up their portfolios with PID prevention and recovery systems, virtual power plant solutions, energy management systems, and tools that allow for remote or even predictive maintenance, it appears the hardware development of inverters has been relagated to the sidelines of the inverter game. Manufacturers, however, have not forgotten hardware and new developments should not be neglected as they retain great potential.

String inverters can also provide flexibility to a system, where previously the system’s size was determined by the number of central inverters and blocks that can be fitted on the site. The problem is that nature ever so often confronts system architects with crests, hills, and other pesky diagonal limitations, leaving architects no other choice but to leave big gaps, where arrays of modules could have been neatly placed. Oddly shaped plants experience sudden spikes in system costs for many reasons.

String inverters, on the other hand, could neatly fill those gaps. And with many easy-to-develop spots in vibrant markets already taken, EPCs have to get increasingly creative to construct plants in highly inaccessible terrain, turning to string inverters to adapt to conditions. With innovation going forward, some inverter suppliers say they have found ways to reduce string inverter weak spots in utility-scale applications. The conflict then might not be as intractable as it first appears.

Centralized string inverter setup

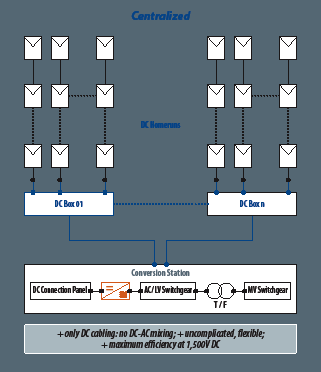

In a persistent belief in the potential of string inverters, companies like Sungrow Power Supply Co. Ltd. and Refu Elektronik GmbH have presented centralized architectures for string inverters. What sounds like an oxymoron combines the advantages of central and string inverters. They say that arranging string inverters in a setup that is more reminiscent of that of a central inverter can cut down cabling costs, minimize the efficiency loss associated with string inverters, simplify installation, and eliminate the necessity for combiner boxes resulting in lower balance of system (BOS) costs.

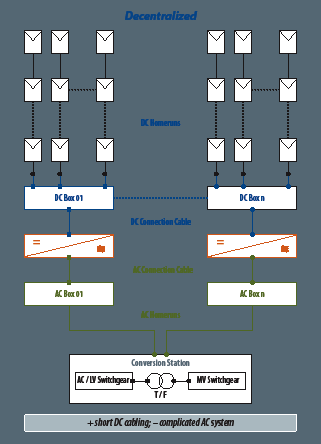

In such a setup, an array of string inverters is installed at a central location within the plant – sometimes even in a container making it look like a central inverter, as opposed to being placed at the end of each array and string. This setup allows for a higher ratio of DC cabling from the module to the inverter. Depending on system architectures, AC cabling is either considerably shortened or wholly omitted. This cabling has an advantage in that the DC circuit uses a higher voltage at a lower current, in turn minimizing power losses, system architects say. Some calculations state that the AC power loss for a central inverter setup is around 0.15%, whereas it can be 1% in decentralized string inverter architectures.

Installation costs reduction

Installation costs are a big argument for string inverters, though it could work both ways. Advocates of the central inverter argue that installing dozens of string inverters and mounting poles requires more work hours than placing a central inverter on a level bed. On the other hand, the shift towards increasingly remote sites makes smaller inverters that don’t have to be moved by large trucks and cranes a valuable commodity. Not only can it be tough to get heavy machinery to a site, but in some countries, such machinery is also hard and expensive to get hold of.

If an EPC can have string inverters installed by hand, it can under certain circumstances make the job significantly easier than placing a shipping container-sized central inverter in hilly surroundings where in the worst-case scenario there are unsealed access roads. If the concept works, this may be a decisive advantage over central inverters.

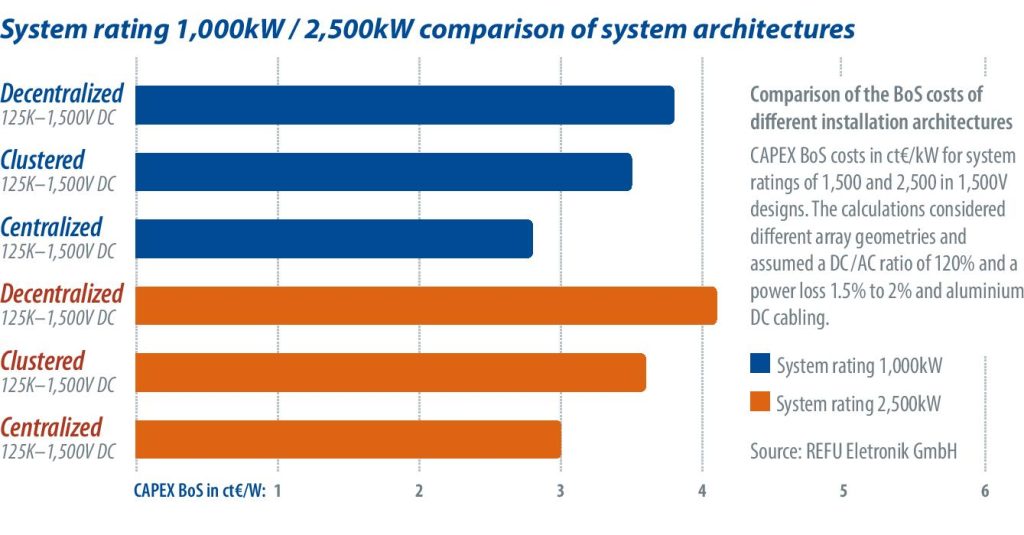

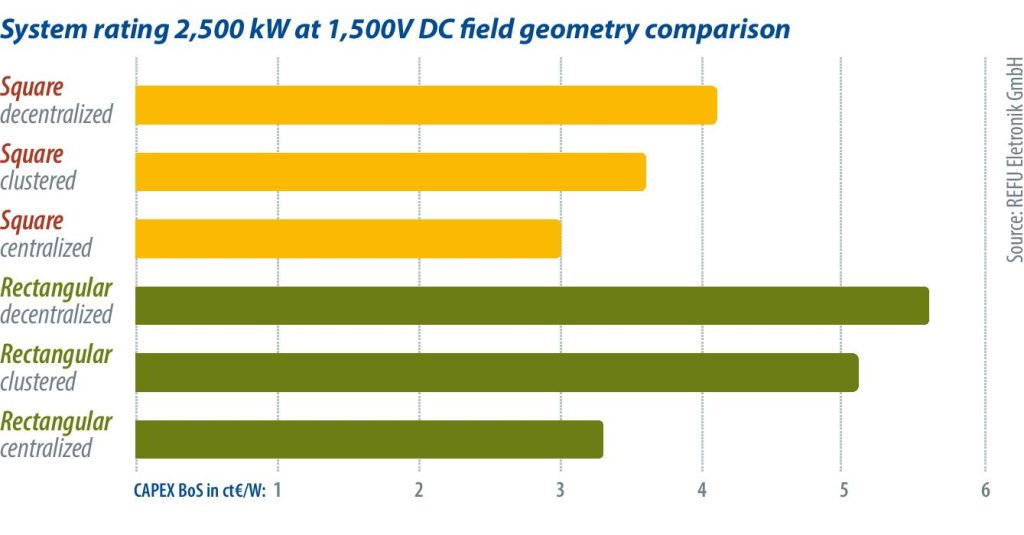

Inverter supplier Refu presented the concept at Intersolar Europe last year. Based on research data, the engineers at Refu are convinced that string inverters will take a more prominent role in future installations and that the centralized string inverter is providing the decisive advantages to make this leap. Especially when looking at system layouts, the research from Refu finds that odd PV plant shapes have considerable effects on the capex in BOS. The BOS capex per watt is more than €0.015/W higher in decentralized square systems than in oddly shaped decentralized systems.

This delta has been narrowed such that it is neglible when system architects deploy a centralized architecture according to Refu’s data.

“So far, we have received great responses for the REFUcube concept, and we see that we are getting more good reactions from our customers. Worldwide multiple projects which are being developed right now deploy this type of inverter setup. We also managed to deliver on the ‘local content’ requirement, through our local partners, which we had to fulfill for some projects. Also in Germany, we see very high attention for the product in the 750 kW market,” states Christian Buchholz, Head of Product Management Energy & Solar, Refu Elektronik GmbH, in an interview with pv magazine.

Splitting what once belonged together

Another innovation coming from string inverter developers are two-compartment inverters. The connection box and power unit are separated in these units. The power unit is mounted onto the connection box after the former has been installed. This design has a range of advantages, according to companies offering this solution.

As string inverters are taking increasingly more space in the utility-scale market, Leonardo Botti, Head of Product Management at ABB, says system costs and BOS had to be addressed. “Therefore, the trend moved towards bigger string inverters, as one would need less of them of course,” he continues. “Installing a 2.5 MW site would require 14 of our PVS-175 models, but around 25 wide-spread 100 kW units. To still be able to provide the advantage of delivering an inverter that can easily be handled by two people we have split the power unit and the connection box.”

Even cash flow for EPCs

Refu, also a supplier of such inverters, explains that an added benefit is that system costs can be distributed more evenly throughout the construction period, making it easier for EPCs to finance projects and provide the funds at the right time. The reason for this is that connection boxes and power units can be bought and paid for separately, weeks apart.

Module installation and cabling are usually carried out at an early stage of the construction of a solar farm. This means that traditionally the inverter would need to be installed in the field, as it is necessarily part of the cabling.

With this new approach to plant architecture, only the connection box has to be installed, and the power unit can be mounted onto it right before the commissioning of the plant.

Lower maintenance costs

Additionally, the companies that deliver such solutions maintain that troubleshooting can be made much more accessible and opex reduced. As the connection box and power unit are two separate entities, a replacement of the power unit does not require a rewiring of the array. The connection box is unlikely to experience any errors, Refu’s Buchholz says, pointing to the simple architecture of the component. The power unit, on the other hand, is the unit that could experience problems in the field.

Botti concurs and adds that ABB also looked to eliminate the need to rewire the system, as ABB stipulates that a cable that had been in the field for several years might have started oxidizing, connectors could have fastened too tightly for easy O&M, or cables may have stiffened, complicating the job further.

Botti says that 99% of the issues requiring O&M are with the power unit, making it possible to leave the connection box untouched. He specifies that opex could be reduced by 20-30% through this feature.

String inverter companies previously stated that in the event of failure, string inverters could be swapped more efficiently as replacements can be stored on-site. A faulty central inverter, on the other hand, could incur more extended downtimes as its repair or replacement requires more effort, and spare central inverters cannot, or are not, stored on-site. This advantage of string inverters over central inverters would then be improved even more as the exchange of the power unit becomes yet easier.

The Refu product REFUsol 100K was presented at the last World Future Energy Summit (WFES) in Abu Dhabi in January, and ABB presented its PVS-175 at Intersolar Europe in June. Both companies say that their products are ready for mass roll-out in September and by the end of the year, respectively.

ABB tells pv magazine that a demand for this type of inverter has been created already, in the MENA, North American, and Asian markets. These projects consist of full commercial sites, as well as test plants, as the company’s Head of Product Management Botti explains.

Refu says that its new product targets markets where central inverters had previously been installed. Buchholz from Refu says that the Spanish market, for example, is very attractive for the supplier. Inverters installed on many sites are reaching their end-of-life in Spain and require replacement. Other than Spain, the company intends to tap into the broader European, as well as African, MENA, and Asian markets. There is thus nothing to suggest from this decision that this type of product is designed for a niche application.

The trend is clear

“In principle, the REFUsol 100k with its modular design is good for large-scale systems worldwide. Aside from benefiting from simple and fast installation and cabling through the innovative mechanical concepts, customers can profit from the staggered installation and hence optimize the project’s cash flow. These advantages are universal for systems from a certain size and are not limited to special markets,” says Buchholz.

“From our perspective, the market is definitely moving towards string inverters. We have recognized this trend already from the beginning of the solar boom and had at this point the biggest string inverter in our portfolio, the REFUsol 20K. Furthermore, already five years ago we had equipped utility-scale projects of more than 50 MW with string inverters, and our focus will continue in this direction. Especially in emerging markets, comprehensive and fast service and the entailing security of supply is from our perspective only possible with the use of string inverters,” the firm’s Head of Product Management Energy & Solar concludes.

Leonardo, of ABB, is even more concrete on the matter. Speaking with pv magazine, he concludes that: “The innovation and technology trends are here already, but EPCs still have trust in the proven central inverter systems. If you take a look back five years ago, 100% of the utility-scale market was installed with central inverters. Nowadays string inverters have caught up to take 40% market share, and in three to five years’ time central inverters will have probably 30% market share. It is impossible to say what the market will look like in 10 years’ time. ABB, is supplying and will supply both solutions to cover the whole market.”